P&L Statement: Your Ultimate Guide to Year-End Financial Review

Are you finding it tough to track your vacation rental business’s financial health in 2025? You’re not alone.

For vacation rental owners and managers, the close of the year is a pivotal moment. It is a time to move beyond daily operations and assess the true financial story of your portfolio. A meticulously prepared P&L Statement is the most critical tool for this annual review.

This financial document provides the definitive verdict on your year, turning a year’s worth of bookings, expenses, and efforts into a clear picture of profit or loss.

As the global vacation rental sector is projected to generate over $105 billion in revenue by the end of 2025, understanding your slice of that pie is more important than ever.

This guide will walk you through the essential steps of conducting a year-end financial review using your P&L Statement, helping you close the books on 2025 with confidence and insight for the year ahead.

As well as showing you how Doinn is more than a smart scheduling tool, it’s a complete suite designed to help you build your ytd profit and loss statement, covering much more than just OPEX and CAPEX.

Understanding YTD P&L Statements

Ever wonder how vacation rental property managers keep their financial pulse steady in a fast-changing market? The answer is often the ytd p&l statement. This essential report provides a running tally of your rental business’s income and expenses from the start of the year up to the present date.

Unlike monthly or quarterly profit and loss statements, the YTD version gives you a big-picture view that grows richer with every booking and expense.

For instance, you can see if your profits are on track or if unexpected costs are eating into your margins. This ongoing analysis is crucial, especially as the vacation rental industry grows more complex by the minute.

What is a YTD Profit and Loss Statement?

A ytd profit and loss statement is a financial summary showing your total income and expenses from January 1st through December 31st. Unlike a monthly P&L, which only covers 30 days. This helps property managers track financial health without waiting for the year to close.

Why is this so important? The vacation rental market is never static. Bookings spike in summer, then drop in winter. With a p&l statement, you can compare how your business is performing now versus the same time last year, and adjust your strategies accordingly.

Why Your Year-End P&L Review is Non-Negotiable for 2025

The financial landscape for vacation rentals has shifted significantly. While demand is growing, so is competition and regulatory complexity. In this environment, a year-end P&L Statement review is not just an accounting task, it is a strategic imperative.

This review allows you to:

- Measure True Profitability: Go beyond gross revenue to understand your net profit margin, the ultimate measure of success.

- Prepare Accurately for Tax Season: A well-organized P&L provides all the income and deductible expense data needed for your tax return, potentially saving you money and stress.

- Inform Your 2026 Strategy: Data from your 2025 performance is the best foundation for setting rates, planning budgets, and making investment decisions for the coming year.

Failing to conduct this review means flying blind into the new year, missing crucial opportunities to optimize and protect your investment.

The Anatomy of a Year-End Vacation Rental P&L Statement

A comprehensive P&L Statement for your vacation rental breaks down into three core sections. Accuracy in each is paramount for a useful review.

1. Revenue: Accounting for Every Dollar Earned

Start by collecting every piece of income and expense data related to your properties. This includes bookings from platforms like Airbnb and Booking.com, cleaning fees, add-ons, and even minor charges.

Don’t forget to track operating expenses (OPEX), capital expenditures (CAPEX), utilities, and repairs. To simplify, use integrations between your property management system (PMS) and accounting tools.

- Additional Guest Fees: Cleaning fees, pet fees, late check-out charges, and any damage waivers.

- Other Income: Commissions from local partnerships or referrals.

Doinn offers an all-in-one solution, combining scheduling, financial planning, and automated data aggregation to streamline this step. Export data effortlessly and reduce manual errors. If you prefer spreadsheets, the Short-Term Rental Spreadsheet Template can help you get started tracking business performance for your ytd profit and loss statement.

For example, exporting a CSV from Airbnb or your PMS makes it easy to import accurate figures.

2. Expenses: The Critical Breakdown

List all operating expenses, such as cleaning, supplies, staff, and utilities. Identify capital expenditures like new furniture, renovations, or major appliance purchases. It’s crucial to distinguish between fixed costs (like insurance) and variable costs (like utilities or repairs).

This is where precision matters most. Expenses are typically divided into two fundamental categories:

- Operating Expenses (OPEX): These are the day-to-day costs of running your rental. Common examples include property management fees, utilities, cleaning services, supplies, marketing, and insurance.

- Capital Expenditures (CAPEX): These are larger investments that improve the property’s long-term value, such as replacing an appliance, installing a new roof, or renovating a bathroom. It is crucial not to mix these with routine repairs, as they are treated differently for accounting and tax purposes.

Industry data suggests allocating 8-12% of gross annual income for maintenance and repairs and setting aside 1-3% of the property’s value annually for capital expenditures to ensure financial health.

3. The Bottom Line: Calculating Net Profit

Now, subtract your total expenses from your total revenue to find your gross profit. Adjust for any refunds, cancellations, or chargebacks that may have occurred. Then, subtract additional costs like taxes and interest to determine your net profit.

- Gross Profit: Calculated as Total Revenue – Operating Expenses (OPEX).

- Net Profit (or Loss): The final figure, calculated as Gross Profit – All Other Expenses (including CAPEX, taxes, and interest). This is your property’s true financial performance for the year.

A well-managed vacation rental typically sees a net profit margin between 15% and 35%. Comparing your result to this benchmark is a key part of the review.

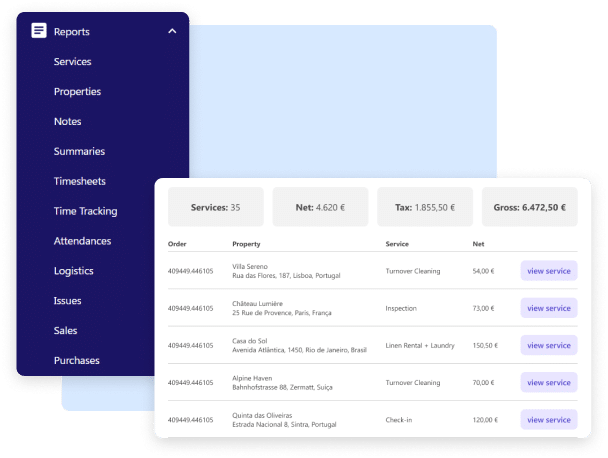

Actually, with Doinn’s dashboard, you can instantly view gross and net profit across multiple units, making it easy to monitor performance. For example, a 10-unit property manager might see gross profit margins rise after adjusting cleaning schedules or negotiating better supplier rates. Your P&L statement should always provide a clear, up-to-date snapshot of your business health.

Common Mistakes and How to Avoid Them

Navigating the financial side of vacation rentals is tricky, even for the pros. The industry gets more complex by the minute, and small errors can lead to big headaches. Let’s break down the most common mistakes property managers make when building a ytd profit and loss statement, and how you can stay one step ahead.

Misclassifying Expenses and Revenue

One of the most frequent pitfalls in creating a ytd profit and loss statement is confusing operating expenses (OPEX) with capital expenditures (CAPEX). For example, buying a new refrigerator is a CAPEX, while a routine cleaning bill is OPEX. This mix-up can distort your financial picture and throw off your tax reporting.

With Doinn’s financial module, you can automate the categorization of expenses and revenue, reducing manual errors. Doinn’s suite isn’t just for smart scheduling, it helps you track every dollar, from cleaning fees to maintenance upgrades.

Overlooking Seasonal Variations

Ignoring the highs and lows of the rental calendar is another big mistake. If your ytd profit and loss statement doesn’t account for summer surges or winter slumps, you’ll miss key trends. For instance, a spike in summer bookings might hide slow months if you only look at the annual total.

Doinn’s analytics let you spot these seasonal swings instantly. You can compare periods, track occupancy changes, and adjust your strategy before small problems snowball. By watching for these patterns, property managers can make smarter pricing and staffing decisions, keeping your business agile.

Not Reconciling Data Regularly

Failing to reconcile your financial data each month leaves you open to missing expenses, duplicate entries, or vendor invoice errors. Over time, this can seriously skew your ytd profit and loss statement, making it tough to trust your numbers.

Doinn’s platform integrates with your PMS and accounting tools, streamlining the reconciliation process. Real-time syncing means you always have up-to-date financials across all your properties. Setting aside time each month for reconciliation, with Doinn’s support, ensures you catch mistakes early and maintain a clear, reliable financial record.

Leveraging Technology to Transform Your Year-End Review

Manual data entry and spreadsheet management for a year’s worth of transactions is time-consuming and error-prone. Modern property operations platforms are designed to automate this process, turning a week-long chore into a task that can be completed in an afternoon.

An integrated platform like Doinn connects directly with your property management system (PMS) and booking channels. It automates the collection and categorization of financial data from every cleaning, maintenance job, and booking. As noted in industry analyses, companies using such automated financial reporting can save over 40 hours each month on manual administrative tasks.

For the year-end review, this means you can “generate P&L statements and track expenses for every specific job” instantly. Instead of chasing receipts, you have a real-time, accurate financial ledger at your fingertips, allowing you to focus on analysis and strategy rather than data entry.

Turning 2025 Insights into 2026 Strategy

Your reviewed P&L is a roadmap for the future. Here is how to use it to build a more profitable 2026.

Furthermore, with regulations tightening in many markets, a clean financial record from your P&L Statement is invaluable for proving compliance and professional operation to local authorities.

Conclusion: Closing the Books with Confidence

The discipline of conducting a thorough year-end P&L Statement review is what separates reactive rental owners from proactive, professional managers. It transforms a year of activity into a clear financial narrative, highlighting strengths to build upon and weaknesses to address.

As you prepare for 2026, remember that profitability is increasingly the “north star” for the industry. By embracing a structured review process and leveraging technology to automate the heavy lifting, you equip your business not just to survive, but to thrive in the competitive and evolving vacation rental landscape.