7 Key Insights Into Profit And Loss Balance Sheet

For service providers in the vacation rental and hostel sector, 2025 presents both significant opportunities and growing financial complexities. Properties are managing more units than ever, and owners demand greater transparency and efficiency. In this environment, achieving a clear and accurate view of your financial health is not just helpful it is essential for survival and growth.

Many cleaning and maintenance companies struggle to accurately assess their true profitability and long-term stability. They may see healthy revenue but wonder where the cash goes each month. The solution to this challenge lies in mastering a fundamental financial tool: the profit-and-loss-balance-sheet understanding.

This comprehensive guide will deliver seven actionable insights to help you leverage your profit-and-loss-balance-sheet for improved growth, operational efficiency, and long-term sustainability.

The Critical Role of Financial Clarity in Property Services

Financial clarity is the cornerstone of a thriving service business. For companies supporting vacation rentals and hostels, this means understanding not just if you are making money, but how and where you are making it. A deep dive into your finances allows you to make informed decisions, justify your value to property owners, and build a resilient business model.

Relying on gut feelings or incomplete data is a significant risk. A structured approach to your profit-and-loss-balance-sheet provides the evidence needed to steer your company with confidence.

Understanding Profit and Loss Statements and Balance Sheets

It is important to clarify a common point of confusion. A “profit and loss balance sheet” is not a single document. It refers to two critical, interconnected reports: the Profit and Loss (P&L) statement and the Balance Sheet.

The Profit and Loss (P&L) Statement shows your revenues and expenses over a specific period, such as a month or a quarter. It answers the question, “Was the business profitable during this time?” It details income from your services and subtracts all costs, culminating in a net profit or loss figure.

The Balance Sheet, on the other hand, provides a snapshot of your company’s financial position at a specific point in time. It outlines what you own (assets), what you owe (liabilities), and the resulting owner’s equity. It answers, “What is the business’s net worth right now?”

For property service providers, reviewing only the P&L can be misleading. You might show a profit for the month, but a simultaneous balance sheet could reveal that slow-paying clients have created a cash flow shortage. Or, it might show a high level of debt used to purchase new equipment.

Regularly reviewing both statements together gives you a holistic view. This practice is often linked to a 30% improvement in cash flow management. Furthermore, property management companies you work with may require certain financial health checks before formalizing partnerships.

For actionable tips on interpreting these reports, see Analyzing Profit & Loss Statements for Cleaning Businesses.

How Financial Insights Transform Property Service Operations

Actionable insights from your profit-and-loss-balance-sheet go far beyond basic bookkeeping. They directly influence and improve your daily operations. Detailed financial reporting enables better budgeting, smarter resource allocation, and the identification of profit leaks.

For instance, by analyzing costs per property, you can identify which vacation rentals are truly profitable. A high-turnover downtown apartment might generate more revenue than a quiet suburban home, but its cleaning and restocking costs could be much higher. This data empowers you to have informed conversations with property owners about service adjustments or pricing.

These financial statements also inform your staffing and scheduling. You can spot trends like rising overtime costs during peak tourist season and plan accordingly. By understanding your financial data, you can make operational decisions that boost both profitability and client satisfaction.

7 Key Insights Into Profit And Loss Balance Sheet 2025

The financial landscape for service providers is evolving rapidly. Leveraging a robust understanding of your profit-and-loss-balance-sheet is now a fundamental requirement for staying profitable and competitive. Here are seven insights designed to help your business make smarter, data-driven decisions.

11. Tracking True Profitability Beyond Revenue

Many service companies focus primarily on top-line revenue. However, the real measure of business health is net profit. Your profit-and-loss-balance-sheet reveals the complete picture, including often-overlooked costs specific to property services.

These hidden costs can include last-minute cleaning requests, travel time between distant properties, and the restocking of high-end amenities. A vacation rental cleaning company might discover that after allocating all these costs, certain contracts are actually losing money.

Key Actions for Property Managers:

- Regularly compare the gross and net profit margins for each property you service.

- Use this data to identify which property types and owners are the most profitable partners.

- Companies that track their full cost structure through their profit-and-loss-balance-sheet often see profit margins improve by up to 15%.

2. Identifying Cost Drivers and Reducing Operational Waste

In the property service industry, the main cost drivers are typically labor, cleaning supplies, and equipment maintenance. A detailed review of your profit-and-loss-balance-sheet uncovers inefficiencies that may not be immediately obvious.

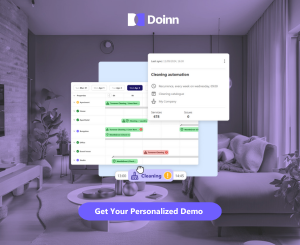

For example, if your supply costs are consistently over budget, it could indicate overuse, lack of inventory control, or even theft. A platform like Doinn can be instrumental here. Its inventory tracking features help you monitor supply levels and usage per property, minimizing losses and optimizing your purchasing cycles.

Key Actions for Property Managers:

- Benchmark your expenses for supplies and labor against industry averages.

- Implement a system to track inventory usage against specific property turnovers.

- Businesses that systematically optimize expenses using profit-and-loss-balance-sheet insights can save 10-20% annually.

3. Managing Cash Flow for Sustainable Growth

Understanding the difference between profit and cash flow is critical. You can be profitable on paper but still run out of cash. Your profit-and-loss-balance-sheet provides visibility into accounts receivable (what clients owe you) and accounts payable (what you owe suppliers).

Delayed payments from property management companies can make it difficult to cover your weekly payroll. By forecasting cash flow using historical profit-and-loss-balance-sheet data, you can anticipate shortages and take proactive steps.

Key Actions for Property Managers:

- Closely monitor your accounts receivable aging report.

- Adjust your billing cycles to align with your major expenses, or consider requiring deposits for large projects.

- Since a significant percentage of small business failures are linked to cash flow problems, using your profit-and-loss-balance-sheet for forecasting is a essential best practice.

4. Setting Data-Driven Pricing and Service Strategies

Your profit-and-loss-balance-sheet insights empower you to set prices based on actual costs and profitability, not guesswork or competitor pricing alone. Reviewing P&L data often reveals that certain services are underpriced.

A hostel cleaning contract might include deep-cleaning common areas daily, a task that consumes more time and supplies than initially estimated. Segmenting clients and services within your financial analysis enables targeted negotiations.

Key Actions for Property Managers:

- Conduct a detailed cost analysis for each type of service you offer (e.g., standard clean, deep clean, linen restock).

- Compare your budgeted figures to actual results to refine your estimating process.

- Use this data to confidently discuss pricing with your property management clients, ensuring your rates are both competitive and profitable.

5. Leveraging Financial Ratios for Business Health Assessment

Key financial ratios, calculated using data from your profit-and-loss-balance-sheet, provide a quick snapshot of your company’s health. Lenders and potential partners often use these metrics to evaluate your business.

The current ratio (current assets divided by current liabilities) measures your ability to pay short-term debts. The gross profit margin indicates how efficiently you are producing your services. The debt-to-equity ratio shows how much your company is financed by debt versus owner investments.

Key Actions for Property Managers:

- Calculate your key financial ratios on a quarterly basis.

- Set internal benchmark targets for these ratios to track your progress over time.

- Use this analysis for early detection of financial risks and to support applications for business loans or lines of credit.

6. Using Historical Data for Forecasting and Scaling

Year-over-year comparisons in your profit-and-loss-balance-sheet reveal powerful seasonal trends and growth patterns. This is especially crucial in the vacation rental and hostel sector, which experiences predictable highs and lows.

By examining historical data, you can anticipate peak demand seasons. This allows for proactive hiring of temporary staff and strategic planning of inventory purchases. Building rolling forecasts supported by your financial data gives management the agility to respond to market changes.

Key Actions for Property Managers:

- Analyze your P&L statements from the same period in previous years to forecast upcoming busy seasons.

- Use this information to create dynamic staffing schedules and budget for seasonal inventory increases.

- Businesses that use financial forecasting are significantly more likely to hit their growth targets.

7. Integrating Technology for Real-Time Financial Insights

In 2025, digital tools have transformed financial management. Cloud-based solutions automate expense tracking, invoicing, and reconciliation. This saves valuable time and reduces manual errors.

Doinn’s cleaning business software platform is designed specifically for service providers in the property sector. It integrates directly with property management systems, ensuring that labor and supply costs are automatically allocated to the correct property. Customizable dashboards provide real-time alerts and key metrics, making it easy to monitor your financial health.

Key Actions for Property Managers:

- Invest in an integrated software solution that automates data collection from your daily operations.

- Use real-time dashboards to monitor profitability per property and track key performance indicators

- Companies that embrace automated financial reporting often save over 40 hours each month and reduce manual errors, gaining a decisive edge in operational efficiency.

How Doinn Reports Empower Service Providers with Financial Insights

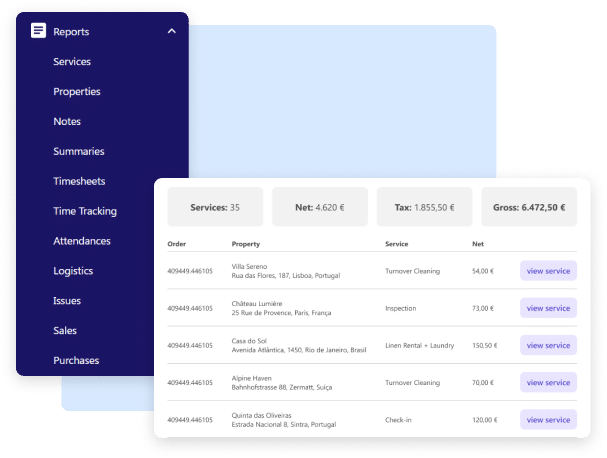

Modern vacation rental and hostel service providers need more than basic spreadsheets. Doinn offers an AI-powered platform that transforms how these companies manage their financial health, directly addressing the need for a clear profit-and-lost-balance-sheet overview.

With Doinn, generating accurate financial reports becomes effortless. The system automates data collection from daily cleaning and maintenance operations. It instantly creates up-to-date P&L statements and balance sheet insights. Real-time dashboards break down revenue, expenses, and profitability by client, property, or service line.

This gives managers immediate, actionable insights. For example, a cleaning company used Doinn to discover that certain hostel contracts had the lowest margins due to high linen laundry costs. They were then able to adjust their pricing model to include a separate laundry fee, which boosted profitability.

The results are clear. Companies using Doinn’s profit-and-loss-balance-sheet tools report significant operational cost savings and reclaim dozens of hours each month through automation. This allows business owners to focus on growth and client service instead of manual data entry.

Best Practices to Maximize Your Profit-and-Loss-Balance-Sheet Insights

For service companies, maximizing the value of your financial data is essential for sustainable growth. Adopting a disciplined approach to financial management allows you to uncover savings and make smarter decisions.

Establish Regular Financial Review Cycles

Set a consistent schedule to review your full profit-and-loss-balance-sheet. This should happen at least monthly. This routine helps you identify trends and address issues before they become major problems.

Investing in financial training for your operations managers can also help them understand how their decisions impact the company’s bottom line.

For more detailed recommendations, explore Cleaning company best practices to enhance both operational and financial performance.

Set Clear KPIs and Empower Data-Driven Decisions

Define key performance indicators (KPIs) for profitability, cost control, and cash flow. Use your profit-and-loss-balance-sheet to measure progress against these targets. Empower your team leads to use this data when making daily decisions about scheduling and resource allocation.

Leverage Technology and Strategic Collaboration

Implement automated financial tools like Doinn to streamline data collection. This reduces errors and saves time, allowing you to focus on analysis rather than data entry.

Furthermore, collaborate with a qualified accountant or financial advisor. They can provide deeper analysis of your financial statements and help you spot opportunities you might have missed.

Conclusion and Next Steps for Property Service Managers

Mastering your profit-and-loss-balance-sheet is a powerful step toward building a more profitable, efficient, and resilient business. The insights gleaned from these documents enable you to move from reactive problem-solving to proactive strategic planning. You can confidently optimize your operations, justify your pricing, and build stronger partnerships with the property managers and owners you serve.

The path to financial clarity in 2025 is paved with data. By embracing the insights and best practices outlined in this guide, you position your company for sustainable success in a competitive market.

Your Key Actions for the Coming Quarter:

- Schedule a Deep Dive: Block time this month to conduct a thorough review of your last quarter’s P&L statement and balance sheet, using the seven insights in this article as your guide.

- Audit Your Tech Stack: Evaluate your current financial tools. Are you spending too much time on manual data entry? Schedule a demo with Doinn to see how automation can provide real-time profit-and-loss-balance-sheet insights tailored to property services.

- Initiate One Pricing Conversation: Use your cost data to identify one underperforming client or service. Prepare a data-backed proposal to adjust the pricing or scope of work to better reflect its true cost and value.

Experience firsthand how Doinn’s AI-powered tools can simplify your financial management and boost operational efficiency. Let’s take the next step toward a more profitable and resilient future together.